-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Auto Loan Interest Rates Hit Record Low in March

The average auto loan interest rate fell to 4.4 percent in March, according to data compiled by Edmunds.com. The 4.4 percent car loan rate is the lowest since 2002, when Edmunds.com started tracking auto finance data.

When looking at year-over-year data, March 2010’s rate is a decline of 1.4 percent compared to March 2009’s average auto loan rate of 5.8 percent.

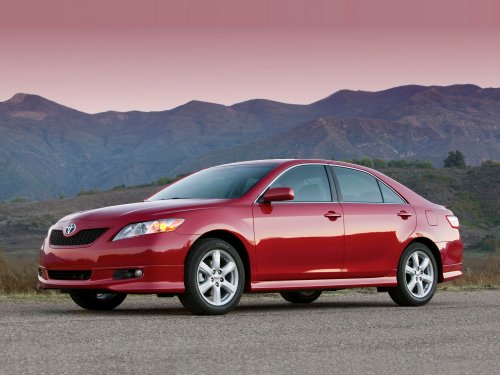

Toyota had the lowest average car loan rate in March at 1.9 percent. Mazda came in second with an auto loan rate of 2.5 percent and Mercury was third at 3.3 percent. Kia had the highest average car loan interest rate in March at 7.1 percent. If you know you have good enough credit to qualify for the low interest rate incentives, you may want to add Toyota, Mazda and Mercury to your list.

"Low interest financing is compelling for consumers because those who qualify often enjoy greater savings than they would get from a cash-back offer," Jessica Caldwell, senior analyst for Edmunds.com, said in a statement. "Low APR offers are also better for automakers, because they are less damaging to brand image and residual values."

Toyota had the lowest auto loan rate in March at 1.9 percent.

Edmunds.com also reports that Subaru had the shortest average car loan term at 60.9 months, and the highest average down payment of $3,911. BMW had the highest average down payment of the luxury brands of $13,614, and the shortest average auto loan term at 52.4 months.

Dodge‘s 67-month average car loan term was the industry’s longest, followed by Chevrolet at 66.6 months and Hyundai and Kia at 66.1 months.

Looking at total amount financed and monthly payments, Edmunds.com found that Scion buyers had the lowest average auto loan amount of $18,978, and the lowest average monthly payment of $348. Mercedes-Benz buyers’ total average car loan amounts were the highest at $40,737, and they also had the highest average monthly payment of $827.