-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

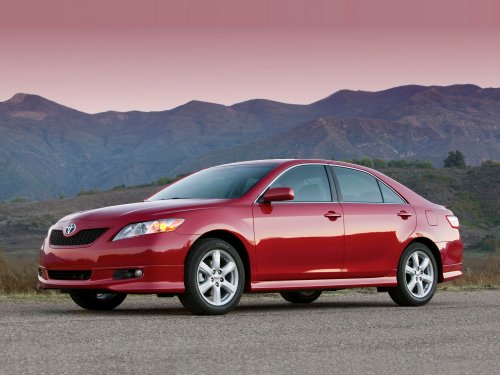

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Car Loans 60 Days Past Due Increase 21.2 Percent, Still Less Than One Percent Overall

The number of car loans 60 days past due climbed 21.7 percent from the second quarter of 2008 to the second quarter of 2009, according to Experian Automotive. The number of consumers who are 60 days past due is still less than one percent overall though.

In the second quarter of 2009, 0.80 percent of all auto loans were 60 days past due, compared with 0.66 percent during the second quarter of 2008.

Experian Automotive also reports that 30-day car loan delinquencies increased by 14.6 percent in the second quarter of 2009 to 3.06 percent overall, up from 2.67 percent the year before. Combined, 30- and 60-day car loan delinquencies accounted for $25.5 billion in at-risk loans.

The average length of new car auto loans fell from 63 months in the first half of 2008 to 62 months in the first half of 2009. The average car loan amount increased by $105 to $24,265 in the first half of 2009, compared to $24,160 in the first half of 2008. Even though total auto loan amounts rose, average monthly payments on new car loans fell to $453 in the first half of 2009 from $458 in the first half of 2008.

Car buyers’ new car auto loans are bigger, but their monthly payments are smaller and the term length is shorter.

"Consumers were financing larger amounts for new vehicles in the first half of 2009 compared with the first half of 2008, which could be a sign that overall consumer confidence is starting to rebound," said Melinda Zabritski, director of Automotive Credit for Experian Automotive. "If new vehicle loan amounts continue to see increases into the third quarter, it will be a very positive sign for the auto industry."

The number of consumers who were 60 days past due on their auto loans increased last quarter, but is still less than one percent overall.