-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

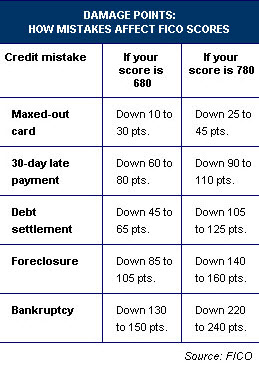

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Credit & Car Loans

Auto Loan Credit Report

There is an auto loan specific credit report that looks at different factors than a normal credit report. This report is only available to car dealers and lending agencies giving auto loans. Because of this, you could get a credit report on your own then go to a dealership and find out their report is different than yours. Don’t assume your dealer is trying to cheat you if this happens. Both reports could be accurate but because they look at different things, the numbers could be different.

Denied a Car Loan?

If your application for an auto loan is denied because of your credit score, you have the right to obtain a copy of your credit report for free from whichever agency issued it. Check the report for mistakes. If you find any, make sure to fix them before you do any more loan shopping.

Settling Old Debts? Always Pay For Deletion

If you’ve had credit problems in the past, you might want to get your credit score up before applying for a car loan. If you’ve had a debt forwarded to a collections agency, there is still a chance to salvage your credit score. Many collections agencies will allow you to ‘pay for deletion’ of your debt from your credit report. Pay for deletion means that your credit report will not reflect the outstanding debt at all. If you don’t pay for deletion, your credit report will read ‘paid in full’, and your credit score will suffer. This could hurt your chances of getting a car loan down the road.

Keep Your Credit Cards

If you’ve had trouble with credit cards in the past but have paid them all off, you might feel inclined to cancel some in order to eliminate some temptation. Don’t. One of the ways your credit score is determined is by comparing your available credit to how much you’ve actually borrowed. Keeping a card with a low balance and a high limit shows that you’re responsible with credit and helps your score.