-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Reduced Credit Lines Won’t Lower Your Credit Score That Much

Consumers who plan to apply for an auto loan soon will most likely check their credit scores first. And with the recent rash of lenders lowering consumers’ credit limits before the new credit card law goes into effect in February, there is concern that it will affect credit scores and your chance of getting a car loan or lease.

A study by FICO reveals that as long as you don’t carry a high balance and you pay off your balance every month, the credit line reductions will have a minimal impact on your FICO score, The Washington Post reports.

FICO’s study looked at several groups of credit card users. For a group of 24 million cardholders with an average FICO score of 760 (usually considered prime borrowers) whose limits were reduced, 12 million had an increase in their scores after their credit line had been lowered. Only 8.5 million cardholders saw their scores drop 20 points or less. And 3.5 million had no change in their FICO scores.

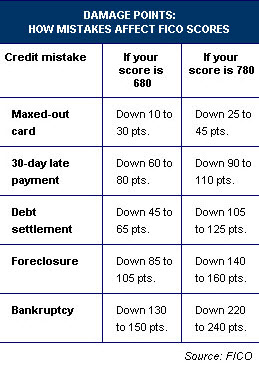

A reduced credit limit apparently won’t hurt your score as much as you think it will. Negative items such as late payments and charge-offs will have a bigger impact on your score. Experts suggest that consumers keep their utilization ratio less than 10% and pay their bills on time. These factors will help you get the best rates on a car loan.