-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

FICO Reveals How Mistakes Can Drop Your Credit Score

If you’re in the market for an auto loan, you probably already know to check your credit score before you apply for financing. You may also be trying to improve your credit score before you buy a car, so you can get a lower interest rate on the car loan.

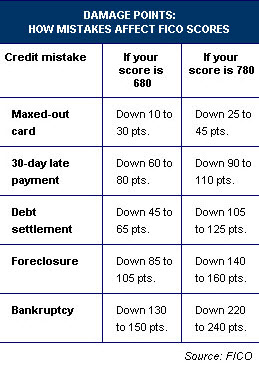

What was once a big secret in the world of credit scores has now been revealed to consumers. FICO recently revealed just how many points your score will drop when you make common credit mistakes. FICO’s “damage points” data really shows consumers how certain mistakes affect their score.

“I hope this information will help people to better understand FICO scores and the value for them of avoiding credit missteps,” says FICO spokesman Craig Watts. “It illustrates key points such as the higher your score, the farther it can fall if you stumble. Getting and maintaining a good score isn’t complicated. We all just need to pay our bills on time, keep credit card balances low and take on new debt sparingly.”

The “damage points” information will be available on myFICO.com starting this weekend, CreditCards.com reports.

One major find from FICO’s “damage points” is that consumers with excellent credit lose more points when they make a mistake than those with average or bad credit who make the same mistake.

CreditCards.com found that a consumer with a FICO score of 780 would see his or her car loan interest rate increase almost 3 percent after making a 30-day late payment on any of his or her accounts. This would cost $26 more each month for the auto loan payment.

A consumer with a FICO score of 680 would see his or her auto loan payment jump $41 more each month following the same 30-day late payment.

But consumers should be aware that people with identical FICO scores can have different credit histories. This means the same mistake could mean different consequences.

This new information from FICO should really help consumers who are in the market for a car loan see what can happen to their score if they make any mistakes. The credit score declines could disqualify them for an auto loan or it may mean they’ll pay a higher interest rate on their car loan.