-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

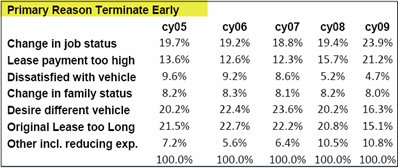

Early Lease Terminations Jump as Job Losses Continue

More and more consumers are terminating their auto leases early, as job losses and pay cuts force them to stop making the monthly lease payments.

In 2009, more than 21 percent of lessees terminated their leases early, compared to the average 15 to 16 percent in 2004 to 2007, according to CNW Research.

Not only are more people terminating their leases early, but they are also terminating the leases with more months remaining than they did in the past. In 2000, consumers terminated their leases with about four months remaining in the contract. In 2009, lessees were terminating their leases with more than 14 months left in the lease.

Can’t make your BMW X5 lease payments anymore? You’re not alone.

According to CNW’s data, the most common reason why people are terminating their leases early is a job status change, at nearly 24 percent. This includes either losing a job completely or a pay cut or loss of commission. The second most common reason to terminate a lease early was that the lease payment was too high.

CNW Research also found that current leases are between 48 and 50 months, which are much longer than the 24 to 36-month leases more common a few years ago. CNW says this is due to more independent lease companies writing the leases and fewer captive lenders leasing vehicles. Consumers took longer leases to keep their monthly payments low and get into a more expensive vehicle.

*CNW Research’s lease data includes both captive and non-captive financial institutions as well as independent lease companies.

Chart via CNW Research