-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

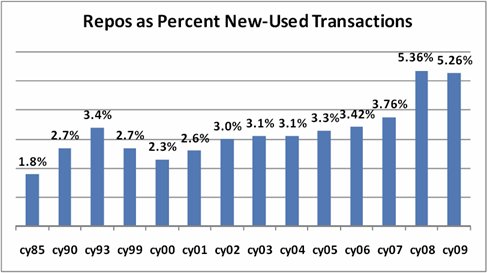

Repossessions Drop in 2009 After Record 2008 Year

Good for the auto loan industry but bad for the repo guy, auto repossessions fell this year after hitting a record high in 2008. Repo businesses aren’t hurting too bad though. New and used vehicle repossessions dropped from 5.36 percent last year to 5.26 percent through the first half of December 2009.

CNW Research’s data shows that the long-term increase in auto repossessions can be traced to steadily easing credit at both captive and non-captive financial institutions. Auto loan lenders then saw less favorable consumer credit scores, which they knew would lead to an increase in repossessions and car loan delinquencies. An increase in interest rates for consumers with bad credit scores allowed auto loan lenders to counteract the repos.

In 2009, auto loan lenders were picky about who they gave a car loan or lease to, which CNW predicts will continue at least through the first half of 2010. Potential repossessions should drop dramatically, according to CNW Research.

Chart via CNW Research.