-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

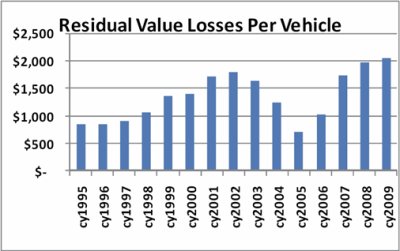

Lease Residual Values Show More of a Future Loss

Auto loans became the primary way to finance a new car purchase last year, as leases were scarce and required a prime credit score to even be considered.

Although leases and leasing incentives are becoming more common now, leases written in 2009 are predicted to have more than a $2,000 difference between the contracted residual value and what the vehicle will likely be worth at the end of the lease, according to CNW Research’s Future Residual Analysis.

This is not necessarily a good thing. The leasing industry almost came to a halt last year as SUVs and trucks that came off lease were worth considerably less than the predicted value. Lessors lost a lot of money from this and were leery to offer leases to consumers, considering the big losses they took.

CNW reports that although the loss-per-vehicle may decline somewhat by the end of the lease contract period due to outside influences such as a run-up in new-car prices causing used values to climb, the trend is what matters.

Chart via CNW Research.