-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

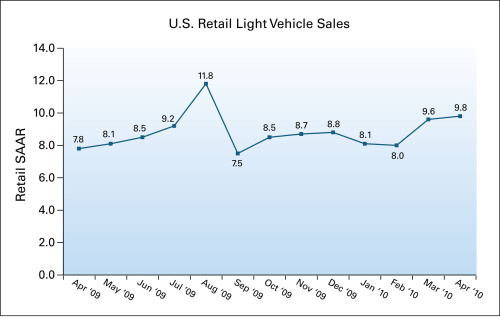

April Auto Sales Expected to Continue March’s Momentum

Thanks to 0 percent auto loans, cash back incentives and discounted lease deals, April auto sales are expected to improve slightly, building on the momentum from March, according to J.D. Power and Associates.

April new-vehicle retail sales are expected to come in at 804,200 units, which represents a seasonally adjusted annualized rate of 9.8 million units. Compared with April 2009, retail sales are projected to increase by 22 percent in April 2010 and the selling rate is expected to increase by 1.8 million units, J.D. Power reports.

"While new-vehicle retail sales in April are benefitting from the continuation of March’s incentive programs, average incentives per vehicle are substantially lower, at $2,800, compared with $3,400 one year ago," said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates, in a statement. "Compared with March, incentives are down by approximately $200, which suggests that the likelihood of an outright incentive war is now lower. This decline in incentives, due to a lower percentage of previous-year models in inventory this year, and the upturn in volume from last April have created a healthier environment — which is consistent with the improved first-quarter financials being reported."

J.D. Power and Associates points out that the automotive industry is starting to see the positive effects of a slow economic recovery.

"Consumer confidence has recently picked up, but it remains low, due in part to an unemployment level still at 9.7 percent," Schuster said. "However, the outlook is improved from where it was at the end of 2009, and the industry is now able to focus on moving forward, rather than worrying about surviving."

Chart via J.D. Power and Associates.