-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

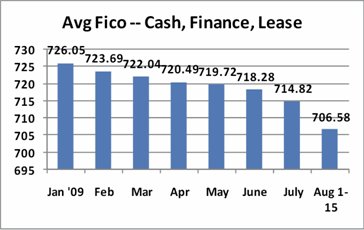

Average FICO Score Drops as Cash For Clunkers Shoppers Get Approved For Car Loans

As consumers flocked to dealer showrooms to take advantage of the cash for clunkers rebate program, auto loan lenders also jumped in on the action. With all those car shoppers needing car loans to buy their new vehicles, it seems auto lenders may have lowered their criteria a little or simply approved more people for car loans.

The average FICO score at the end of July and first few weeks of August dropped to 706.58, according to new data from CNW Research. This is down from January 2009’s average of 726.05.

Auto loan lenders may be loosening their credit criteria because of the huge response of the government’s CARS program. The initial $1 billion in funds ran out in the first week of the program. Another $2 billion was added to the program and about half of the $3 billion in total funds has been used to date.

A $3,500 to $4,500 rebate lowers the amount of risk the lender has to take on that vehicle’s loan, as it essentially lowers the price of the vehicle and the amount financed. Any time an auto loan lender lowers its risk, the consumer generally has a better chance of getting approved for the car loan.

CNW Research’s data shows that the average FICO score needed to get an auto loan has dropped every month, with August seeing the largest decline.

Chart via CNW Research.