-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Fewer Auto Loans Being Approved

Over the past several months, more car shoppers found that lenders were approving them for car loans to buy vehicles. In a surprising turn, fewer auto loans were being approved in September and October, according to CNW Research data.

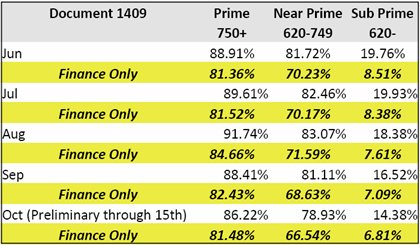

CNW Research looked at consumers in three categories of credit scores (prime: 750+, near-prime: 620-749 and sub-prime: 620 and below). In June, 88.9% of all car loan applications from prime consumers were approved, increasing to 91.7% in August. In September though, only 88.4% of prime car shoppers were approved. So far in October, only 86.2% were approved.

Consumers with near-prime FICO scores also saw the same decline in auto loan approvals during September and October. In August, 83.07% of near-prime consumers were approved, while only 78.93% were approved so far in October. Those in the sub-prime category don’t seem to be having much luck getting approved for auto financing. Almost 20% of sub-prime car shoppers were approved in July, while 16.5% were approved in September.

Why are less people being approved for auto loans now? CNW Research reports that more than a third of the car loan rejections are “people coming to market with poorer FICO scores now believing they can get an auto loan.”

Excluding leases and personal loans, those being financed through a dealership or financial institution hit a high in August at 84.7% for prime borrowers and 71.6% for near-prime, CNW Research reports. Could this increase in approvals be tied to the government’s CARS (cash for clunkers) program?

A decline in auto loan approvals not only hurts the consumers who need a loan to buy a car, but it also hurts the dealerships and manufacturers, since they need all the sales they can get right now.

Chart via CNW Reseach.