-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

New FICO Score Could Help You Get a Car Loan

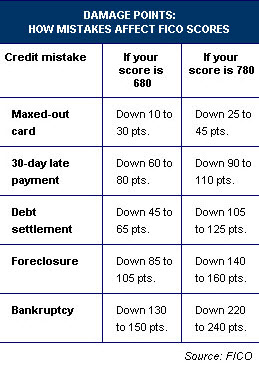

Fair Isaac will be offering a new FICO auto-specific credit score, along with a new general credit score and a new bankcard-specific credit score. The general credit score will be available to lenders today, but the auto loan-specific credit report won’t be ready until April. The new credit scores are designed to be better at determining the risk for lenders, especially for borrowers in the subprime category.

The new FICO scores are designed to raise the scores of responsible borrowers and lower the scores of irresponsible ones.

A new car buyer who only has a short credit history (for instance, a young buyer who hasn’t used much credit through college) will have a higher score under the new system. Also, buyers who have a single missed payment on their credit report won’t be penalized as highly as before, according to The Wall Street Journal.

On the other hand, the new FICO score will lower the credit score of buyers who have a history of missing payments frequently. It will also reduce some credit repair agencies’ ability to manipulate a customer’s score by adding them as an authorized user on accounts held by people with good credit.

So if you’re a responsible car loan shopper, your auto loan-specific credit report will be raised when this new scoring system begins in April. Unfortunately, consumers are not allowed to purchase a copy of their auto loan-specific credit report, so you’ll have to ask to see the dealership or bank’s copy to see what your exact score is.

If this new FICO score for car loans is successful in helping lenders give better car loans, it could help consumers in the form of lower interest rates. Since the interest rate on a loan helps a lender recoup its money, a lower number of loan defaults would mean that lenders could charge lower interest rates.

This new credit score is called the FICO® Risk Score, Classic 08. You can read Fair Isaac’s press release about it here.