-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

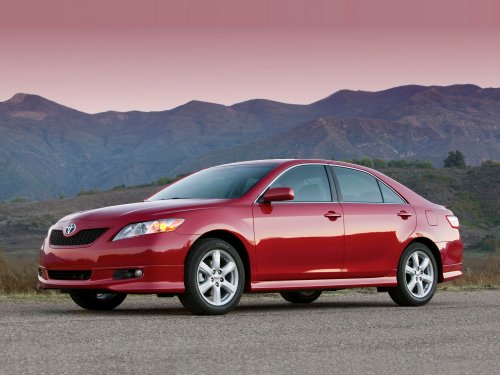

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Reverse Auctions: How Lenders Compete to Finance Your Vehicle

With the Internet putting its mark on a wide spectrum of financial agreements from mortgages to retail, new ‘reverse auction’ sites are bringing this kind of innovation to the market for unsecured personal loans, and that means more options for getting approved for new and used car financing.

A recent announcement from lending auction site MoneyAisle typifies this kind of fast-growing part of the lending industry. Just a few days ago, MoneyAisle proclaimed that their services, which help families and individual consumers find the best car loans, now apply to other kinds of vehicles, like boats and RVs.

So how do auction sites work? Basically, these ‘matchmaking’ services link up those who are seeking loans with other parties that are wanting to get invested in certain kinds of returns based on holding consumer debt. MoneyAisle and other auto loan reverse auctions are similar to others that exist in the mortgage market: usually, the investors offering various loans at specific interest rates are banks and credit unions. They compete to get loan interest, and the borrower wins. Rather than a struggle to the top, where new or used car buyers have to shop around actively for lower interest rates, it’s a ‘race to the bottom’ – lenders compete, and when you go to the dealer’s lot, you profit – that is, if you have already checked out these alternative auto financing options and compared them against what you can get from the dealer.

It’s worth pointing out that the best online lending tools won’t help new or used car buyers who go simply go to the dealer and get in-house financing without shopping around. In these situations, the dealer has no reason to come down on interest rates, not to mention ‘usual’ loan fees and up front costs that often get folded into the mix. As a useful starting point, MoneyAisle cites available interest rates as low as 8.30% – that’s not to say that this is the lowest rate new or used car buyers can get in 2011, but if your dealer is ‘offering’ 20%, this figure will come in handy in negotiating the best deal you can get.

Like the microlending environment, represented by top peer-to-peer sites like Prosper, MoneyAisle helps to present car financing options that can put money back in your pocket, so be sure to keep up on the newest tools and auto financing trends that are, in some ways, the financing dealer’s best kept secrets.