-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

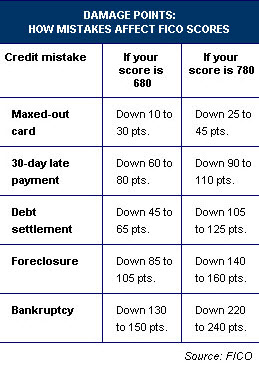

Tight Credit Crunch Affects Auto Financing

The New York Times has a great story on their Web site today discussing how the credit crunch is affecting the auto industry. It talks about how banks and lenders aren’t loaning as much money anymore and as a result, less people are getting financing for a car.

Home owners who would usually take out a home equity line of credit to get a new car aren’t able to do so recently. Plummeting prices of homes and their values are drying up that stream of money.

The article also talks about the increasing repossession rate of vehicles as drivers fall behind on their car payments. As more and more car buyers get turned down for auto financing, besides keeping their current cars longer, what other options are available to those potential car buyers?