-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

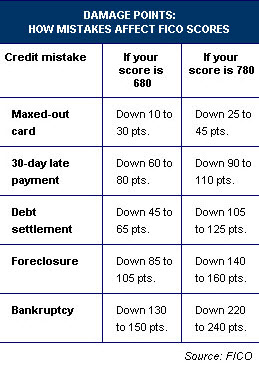

Tips to Protect Your Credit Score From Negative Changes

The recent changes credit card companies are making to consumer accounts is affecting credit scores. When a credit card company lowers your limit without warning, your available credit is lower, which means your credit score may drop.

Another tactic credit card companies have used lately is to raise the interest rates on many accounts. While the government passed new laws last week to stop these kinds of changes in consumer credit card accounts, some of the damage may already have been done.

If you’re thinking about applying for a car loan in the near future, you should check your credit card accounts and your credit score to see if there have been any changes. If you see your credit score has dropped, you may want to increase it before you apply for an auto loan so you can get the best interest rates.

CNBC’s “On the Money” Web Extra gives different ways to protect yourself from these changes that can have a negative effect on your credit score. Credit expert John Ulzheimer says consumers should follow these tips:

1. Don’t wait for your credit card issuers to cut your limit. Make the assumption that some of your limits will be reduced. If you’re reactionary, you may be too late.

2. Think about opening a new card – this week. The reason is that you want more available credit on your reports to compensate from if (when) your credit limits are slashed. Consider opening the card with a smaller lender like a regional bank or credit union as they are in less trouble than the big issuers.

3. Avoid doing anything that will end up closing your account for good. You may get a letter saying your interest rates have been raised – fight the emotional urge to stick it to the issuer by closing your card. Instead, pay off the balance as quickly as possible and keep the account open to protect your score. Don’t let your anger or frustration compound the eventual damage that could be leveled on your credit.