-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

VantageScore – The Credit Score You Don’t Know, But Should

Did you know that the FICO score isn’t the only credit score available? Because it has been around for so long, its name is almost synonymous with the words “credit score”. Credit score, FICO score – same thing, right?

Not at all. The FICO score is a scoring model from Fair Issac. FICO’s competitor, VantageScore, is a credit scoring model most people haven’t even heard of.

If you’re in the market for an auto loan, you should know what the VantageScore is because there are auto lenders who look at your VantageScore and use it to determine whether or not they will give you a car loan.

What is VantageScore?

VantageScore was formed at the beginning of 2006 using a database with two years worth of information, says Barrett Burns, president and CEO of VantageScore Solutions, LLC. It was developed by Experian, Equifax and Transunion, the three major credit reporting companies. VantageScore’s range is from 501 to 990. The higher the score, the less risk a consumer poses to a lender.

“It was developed from the ground up,” Burns explains. “It’s not a remake of another version. We used the years 2003 to 2005 for our information. During those two years, there was significant volatility. Consumer debt rose and subprime lending increased.”

“We developed VantageScore to be more predictive and to increase consistency, especially for mortgages. Other models were developed at different points in time. This is why they are inconsistent.”

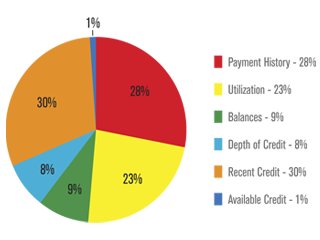

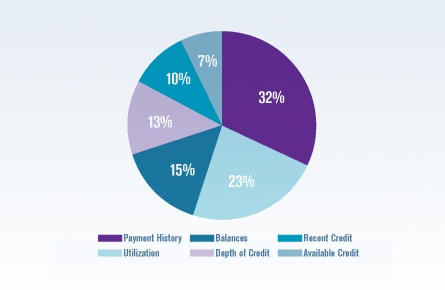

The six components that make up your VantageScore are shown here in this pie chart.

Burns says that the VantageScore is important to the auto finance industry because it helps more people obtain credit.

“We score millions more people in auto finance,” Burns says. “We give more consumers access to credit.”

“We recognize people who use credit differently and infrequently. VantageScore is good for people who have a hard time getting scored and who use credit in nontraditional ways.”

For example, a consumer may be really prudent with credit and primarily use cash, he explains. If they have no credit activity in six months, some scores will drop them and they won’t have a credit score. Also, some credit scores won’t score consumers in the first six months they start to use credit. VantageScore scores immediately after a consumer starts using credit.

Burns says that some of these people who use credit differently may be considered subprime, even though they may pay their bills on time.

“I’m a believer in subprime credit,” Burns says. “Subprime is helpful as long as it doesn’t morph into predatory lending.”

VantageScore and Car Shopping

Consumers repeatedly hear that they should check their credit score before they go to the dealer and apply for an auto loan. Should they check to see what their VantageScore is before they head to the dealer?

“This depends on what bank the dealer uses and if that bank uses VantageScore,” Burns says. “Seven of the top 50 auto lenders use VantageScore.”

What this means is that when you apply for the car loan, the lender may be using your VantageScore, not your FICO score, to determine whether or not they will approve you for the loan. If you don’t know what your VantageScore is, you may be at a disadvantage when it comes time to negotiate your financing.

Consumers can get their VantageScore from Experian and Transunion’s Web sites, Burns explains. There are also educational tools there to help consumers before they apply for credit.

“A knowledgeable consumer should walk into the dealer saying, ‘My score is x. What do you show?’” Burns says. “Also, by asking if the dealer uses the VantageScore system, this will make the consumer come across more educated. Just by asking these questions, it sends a message to the F&I guy.”

By asking the dealer’s finance manager if they use the VantageScore, be aware that they may not know, Burns says. It depends on what the lender reveals to them because there are lots of scores.

VantageScore and Auto-Loan-Specific Credit Scores

VantageScore, like FICO score, is different from an auto-loan-specific credit score. An auto-loan-specific credit score looks more closely at how a consumer has paid their car loan in the past.

Burns, who has more than three decades of lending experience at companies including U.S. Trust, Ford Motor Credit, Bank One and Citibank, says that a misconception about the auto-loan-specific credit score is that all dealers have it available.

“Custom scores, like an auto-loan-specific score, are only used by huge auto lenders,” Burns (pictured right) explains. “The global analytics department at Ford developed algorithms for specific scores. This was possible because they had an enormous database of information. Only a handful of lenders can afford to do that. Most use a generic score, like FICO or VantageScore, when looking at auto loan applications.”

What is Considered a Good VantageScore?

In terms of auto lending, a good VantageScore is hard to define, says Burns.

“The lender sets the cut-off,” he explains. “If they are just prime, the cut-off is high. Subprime is different. It comes down to the lender’s criteria and how much risk they want to buy from the dealer.”

“What is prime changes all the time. A good lender will look at vehicle models to diversify their portfolio. It depends on the lender’s appetite. They may be ‘choking on’ (have a lot of) xyz models, so they will relax their standards on those models. The criteria can also change if a model is no longer made.”

Burns says that with auto lending, there are so many things that happen that the consumer never really knows about during the entire auto loan process.

“There’s all kinds of things going on behind the scenes to ‘move the metal and get it out of the yard’ (sell more cars),” Burns says. “When inventory piles up, dealers say that ‘the metal is against the fence’.”

How Can Consumers Improve Their VantageScore?

To improve a VantageScore, the simple answer is to pay your bills on time, Burns says.

“Consumers should think twice about canceling old credit cards,” he says. “This will erase the history of the account. Also, don’t consolidate your credit cards into one. This chews up your unused lines. Lenders like to know you have available credit for emergencies.”

“Don’t zap your unused lines of credit. Be careful with things like that. If you’re afraid of overusing your credit cards, just cut them up and keep the accounts active.”

Why Most Consumers Have Never Heard of VantageScore

If you’re one of the many consumers who have never heard of VantageScore, you may hear about it more in the near future. Why are there no advertisements and marketing to consumers about VantageScore right now?

“We license the algorithm to the three bureaus and they market it to consumers,” Burns says. “We don’t (market it). They have to get it embedded into the lenders first, which is a very long sales cycle. After that, they will market it more to consumers. Experian is putting more press releases out about VantageScore. The marketplace is big enough for a lot of providers.”

Although FICO scores and VantageScores are different, consumers should probably pull both to see where they’re at and realize that different lenders use different credit scores. Remember, the more you educate yourself and research all your financing options before you head to the dealer, you’ll walk out with the best auto loan rate you can get.

Copyright © 2009 AutoLoanDaily.com. All rights reserved. This material may not be published, rewritten or redistributed without permission.