-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

New Version of VantageScore in Use, Better Predicts Consumer Credit Repayment

A new version of VantageScore is now in use at Equifax, Experian and TransUnion. The new version of the credit scoring model was released in October 2010 and has been in a testing phase since. It was updated to reflect the significant change in consumer credit repayment behavior, said Sarah Davies, senior vice president of product management, analytics and research at VantageScore Solutions.

VantageScore, like other credit scores, is a credit scoring model that predicts how well a consumer will repay his or her bills, and ranges from 501 to 990. Although the FICO score is the most widely used credit score among lenders, VantageScore says its score is used by all of the top five credit card issuers, four of the top five financial institutions and two of the top five auto lenders.

"VantageScore 2.0 is built on a blend of consumer credit behaviors from 2006?2009, which creates a highly predictive score," Barrett Burns, VantageScore Solutions president and CEO, said in a statement. "We’ve recently experienced a variety of economic scenarios, which have impacted consumer behavior of the past several years. This includes an increase in foreclosures in the housing market and changing payment priorities among consumers."

VantageScore 2.0 reportedly reduces algorithm sensitivity to highly volatile behavior that can be found in a single timeframe and extends performance stability over time. Basically, if your house went into foreclosure during the recession but now you are more financially stable and paying your other bills on time, it won’t hurt your credit score as much as it did in the past.

The initial version of VantageScore was developed in 2005 and released in 2006. The company said that as economic conditions change, it’s important to update credit scoring models to reflect those changes.

When applying for an auto loan or lease, remember to ask the lender which credit score will be pulled and which credit bureau your score and credit report will be pulled from.

Also keep in mind that the dealership or lender is most likely also looking at your auto enhanced credit score, which shows lenders how well you’ve repaid your auto loan or lease in the past. Unfortunately, this auto specific credit score is not available to consumers.

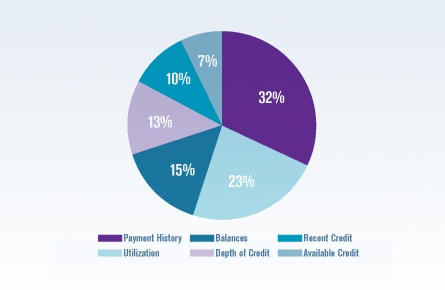

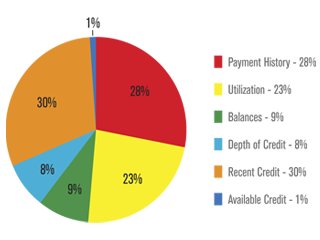

Pie chart via VantageScore.