-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Free Credit Scores – What’s The Catch?

One of the most important steps before applying for a car loan is to find out what your credit score is before you even head to the dealership. Car shoppers will then know where they stand when it comes time to negotiate the auto loan or lease’s financing.

Most consumers have figured out by now that the advertisements about free credit scores really aren’t free. Most services give you your credit score free but make you pay for a credit monitoring package.

The only true free credit report is the one from Annualcreditreport.com, where consumers can get their credit reports once a year for free by law, but must pay for their credit scores.

There are now several new services that give consumers at peek at their credit scores free of charge, The Wall Street Journal reports. Web sites such as Credit.com, CreditKarma.com and Quizzle.com offer consumers a look into the key factors that go into calculating your credit score, what you can do to improve your credit score and how your credit compares to others.

The Wall Street Journal tested the three new services and found that they each offer different information that can help consumers figure out where they stand in the credit spectrum and show them what they look like to a potential lender. Here’s what The Wall Street Journal found:

“All the free sites provided a top-line summary of our credit by highlighting the pieces of data that they thought we were most likely to be interested in, such as how many open and closed accounts we have, our total balances and whether there were any red flags that we should be concerned about.

Credit.com doesn’t yet provide an exact credit score, but estimates where your score will likely fall across the credit-risk spectrum as defined by five major credit-scoring models, including FICO, VantageScore and other consumer credit scores. The site allows users to get updated scores once a month for free.

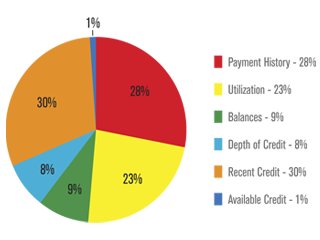

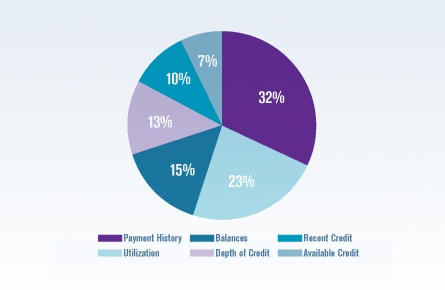

CreditKarma.com, which also relies on TransUnion data, gives you one of the same credit scores that TransUnion sells directly to consumers. In addition, it provides a report card grading consumers from A to F across seven key components affecting their scores and ranks the importance of each factor on a scale of high, medium or low. Users can also play around with a credit-simulator tool to see how their scores might change if, say, they applied for a new credit card with a $10,000 credit limit, or foreclosed on their home. The site allows you to check your score every day.

One thing Quizzle.com offers that the others don’t is a free credit report—and the ability to dispute errors on your Experian credit report on the site. In addition to the free score and report, Quizzle.com also offers a number of mortgage-related tools, so you can see how much the value of your house has changed. The site limits users to a new score and report every six months.

The free sites also offered some helpful tips on how to improve our credit. To keep our overall debt usage low, for example, Credit.com warned us not to close any of our credit-card accounts, since that could cause our "utilization rate"—the amount of available credit that we’re using—to go up and our credit score to go down.

Instead, it advised us to cut up the cards to prevent them from being used fraudulently. Quizzle.com also launched on Wednesday a fee-based service ($75 for four months) that gives users personalized, specific advice on what they can do to improve their scores.”