-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Why Are Credit Scores Different

There was an article in the Wall Street Journal over the weekend about credit scores and how they differ when you apply for credit.

There are instances when the credit score from your yearly free report and the one the car dealers get are different, sometimes resulting in huge differences in your APR. It could even be the difference between getting a prime and subprime interest rate.

How does this happen? Apparently, the scores consumers buy and get free from credit bureaus and Web sites aren’t the same scores that are sold to lenders, insurers, landlords and employers.

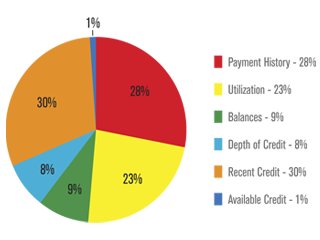

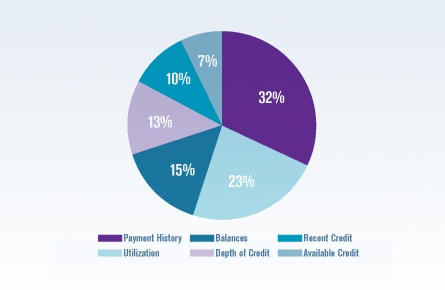

The WSJ says that one reason for this is that there are five different kinds of credit scores:

- 1. The FICO score is used by all mortgage lenders.

- 2. Alternative FICO scores are used for auto loans, installment loans and credit cards.

- 3. VantageScore is being tested by lenders, but is not yet widely used.

- 4. PLUS score is not used by lenders.

- 5. TransUnion TransRisk New Account Credit score may be used by some lenders.

The story talked about how a customer went into a dealer with her credit report that said her score was 640. When the director of finance puller her report though, it said her score was 600. This 40-point difference meant that the customer would end up paying an APR of 11.64%, considered subprime, instead of paying a prime 7.85% interest rate.

The score the lender pulls will depend on the type of credit you are applying for. Even though all credit scores are calculated using the information in your credit report, the formulas being used are slightly different, resulting in considerable differences.

In the story, WSJ suggests that if you are applying for a major line of credit in the near future, like a mortgage or an auto loan, you should buy your FICO score from a service that sells it, so you can get a more accurate score like the one your lender will get. You can also ask your mortgage lender to give you your score for free if you’ve already applied for a loan.

So don’t think the finance manager is trying to pull one over on you if you apply for a car loan and he tells you your score is lower than what you think it is. Chances are, it’s going to be different.