-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

What is Not Included in Your Credit Score

Most auto loan lenders use your FICO score as part of the application process to determine if you’ll qualify for a car loan and if so, at what interest rate. While some auto lenders do use other credit scores like VantageScore, the FICO score is the most widely used.

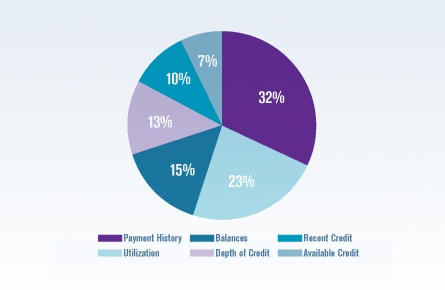

We’ve previously covered what your FICO score is made up of, but there are several items that consumers might think are part of the score that really aren’t. FICO scores consider things like payment history, amounts owed, length of credit history, new credit and types of credit used.

Your FICO score does not consider:

- Your race, color, religion, national origin, sex and marital status. U.S. law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

- Your age. Other types of scores may consider your age, but FICO scores don’t.

- Your salary, occupation, title, employer, date employed or employment history. Lenders may consider this information, however, as may other types of scores.

- Where you live.

- Any interest rate being charged on a particular credit card or other account.

- Any items reported as child/family support obligations or rental agreements.

- Certain types of inquiries (requests for your credit report). The score does not count "consumer-initiated" inquiries – requests you have made for your credit report, in order to check it. It also does not count "promotional inquiries" – requests made by lenders in order to make you a "pre-approved" credit offer – or "administrative inquiries" – requests made by lenders to review your account with them. Requests that are marked as coming from employers are not counted either.

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Whether or not you are participating in a credit counseling of any kind.

If you plan on applying for a car loan or lease soon, keep in mind that some of the things on this list will be on the finance application. They’ll want to know things like where you work, how long you’ve worked there, how much money you make, your date of birth, your marital status, your address and if you’ve ever filed bankruptcy.

Remember to be truthful on your auto loan application because when they run your social security number and pull your credit, the dealer’s finance manager will find out most of these things anyway when he or she looks at your credit report.