-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

How Recent Credit Card Changes Can Affect Getting a Car Loan

I recently received a letter from my credit card company, Chase. It wasn’t even in an envelope. It was simply folded and lightly glued together. Honestly, it looked like junk mail. But I opened it anyway. It’s a good thing I did.

Inside, I started reading the complicated credit card jargon. Chase basically told me they were doubling my interest rate on Dec. 1 and if I didn’t agree to the increase, I could opt-out, but my account would be closed and I’d still have to pay the balance.

The kicker of the whole thing was that when Chase explained their reason for the interest rate increase, they said that “the principal factor we considered in amending your account is maintaining profitability on your account.” I applaud them for being honest with me, but it didn’t make me any less angry about the situation.

I started thinking about how these involuntary changes to consumers’ credit card accounts will affect credit scores. Would an increased interest rate make me look less credit-worthy to a lender? Would a decreased credit limit make me look like I’ve maxed-out my cards? How does this affect my chances of getting approved for a car loan or lease?

“Some of the changes they’re making don’t have any impact on your credit,” says John Ulzheimer, president of consumer education for Credit.com. “Some can be significant.”

If your credit card company increases your interest rate, you shouldn’t be too concerned about it affecting your credit, Ulzheimer says. You will be paying more to carry a balance on the card though.

“Interest rates aren’t reported on your credit reports and aren’t reflected in your scores,” Ulzheimer explains.

But if your credit card company lowers your credit card’s limit or even closes the account, you should take notice.

“Lower credit limits can have a pretty significant impact,” Ulzheimer says. “You’ll look more utilized or maxed-out. The utilization component is the number two factor in the FICO score.”

According to myFICO.com, 30% of your FICO score is your debt-to-available balance, or how much credit you owe versus how much you have available.

MyFICO.com says they recently studied credit card companies lowering credit limits “and found that credit limits have been lowered or inactive card accounts have been closed for roughly one in five American consumers.”

If you are one of the consumers whose account was closed completely, usually due to inactivity, this can affect your credit score in a negative way.

“Having an account closed can be significant for people who only have a couple credit cards and one gets closed,” Ulzheimer says. “Shop around for a few more cards if this happens.”

“Having one or two cards isn’t enough right now. The interest rate is irrelevant unless you have a balance. You want to practice strategic credit use. Get yourself in a position where you’re as immune from the credit crunch as you can be.”

Ulzheimer explains that when an account is closed and you’re only left with one credit card, for example, you’re left to accept whatever changes that card issuer makes. Plus, if they decide to close that account too, you’re really stuck. Having more than one credit card “facilitates a more efficient way of living”, he says.

So if you’ve been a victim of unwanted changes to your credit card account and are in the market to buy a car, you should definitely recheck your credit score before you go to the dealership and apply for an auto loan or lease.

Ulzheimer (pictured right) says that if your account has been changed or closed, you should recheck your report and credit score about 30 days after the change has been made.

“Large credit card companies update your account to the credit bureaus once every 30 days at most,” he says. “Assume it will take much less time though.”

These changes to consumers’ credit card accounts could possibly drop car shoppers’ credit scores enough to where they may receive a lower interest rate on their car loan, or may not even be approved at all.

“Auto lenders use tier-based lending,” Ulzheimer explains. “You could fall to a lower tier.”

Consumers may be wondering if lenders look at a lowered credit limit or closed account in a negative way.

“How it happened is really not relevant,” Ulzheimer says. “It’s going to look bad because of the impact on the credit score. Let’s say you have a $5,000 balance on a credit card with a $25,000 limit. If the lender lowers your limit by $15,000, your 20% utilization just went up to 50%. If your balance is zero, there’s no impact.”

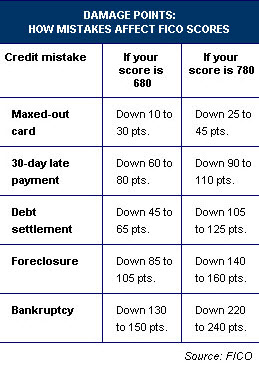

Ulzheimer says it’s important to recheck your FICO score after the changes to your account are made if you’re in the market for a vehicle. If the score changes from 750 to 740, you’ll still be able to get approved at the best interest rates. But if the score changes from 700 to 650, for example, your chances of getting approved for the car loan at competitive rates will be much lower.

“If your score drops from 700 to 600, you should shelve the purchase and do some work to improve your score,” Ulzheimer says. “Unless you want to refinance your auto loan, wait until you can get the best possible deal.”

If you can’t wait to improve your credit score before you buy a car, the lender may ask for a larger down payment and you’ll probably get a higher interest rate, he explains.

Consumers who are in the market for a vehicle should realize that changes to credit card accounts affect their credit scores, which then affect their ability to get a car loan.

“So many people are so disconnected with their credit reports and scores,” Ulzheimer says. “They don’t understand the mechanics behind getting an auto loan. If you’re in a bind and your credit is not in a good position, you’re not in control.”

Once the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act of 2009 goes into effect next year, not all the changes credit card companies are enabling now will be banned.

“Decreasing limits and closing accounts will still be legal,” Ulzheimer says.

“There’s no auto act. They’re not out there trying to juice people like the credit card companies are. The auto financing world isn’t seeing the same changes as credit cards and mortgages. If you have good credit, it’s a great time to buy a car. It’s a shame some people can’t take advantage of that.”

Copyright © 2009 AutoLoanDaily.com. All rights reserved. This material may not be published, rewritten or redistributed without permission.

Top photo via abcnews.com.