-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

National Credit Education Week Reminds Consumers How a Credit Score Affects Car Loans and Leases

Did you know that this week is National Credit Education Week?

Credit is important in so many of our financial decisions. The better your credit score is, the less you’ll spend to borrow money. And most Americans need to borrow money to buy things like houses and cars.

With regards to car loans, the higher your credit score, the lower interest rate you’ll receive from the lender. This means you’ll pay less over the life of your auto loan to borrow the money to buy the car.

In an auto lease, the higher your credit score, the cheaper your monthly payments will be.

According to Fair Isaac, the company behind the FICO credit scoring system, your credit score directly affects your monthly auto finance payments. For example, if your credit score is in the 720 to 850 range, you’ll receive a 6.03% interest rate on a $25,000 car loan. This will make your monthly payment $761.

But if your credit score is between 500 and 589, you’ll receive a 16.16% APR on the same $25,000 car loan. Your monthly payment would be $881.

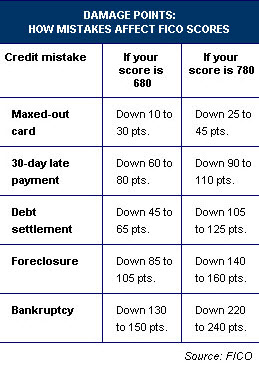

If you are in the process of improving your credit score, you may want to check out some tips from two finance experts we interviewed a few months ago. They have tips for consumers on how to improve your credit score before you apply for a car loan or lease.

Remember to check your credit score before you head to the dealership. This way, you’ll know where you stand when it comes time to negotiate the terms of the car loan or lease.