-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Secret Credit Score Could Make Getting a Car Loan Harder

As of Feb. 14, the Experian FICO score will no longer be publicly available. Experian, along with the two other major credit scoring agencies, currently makes its scores available to consumers through the MYFICO Web site. Equifax and TransUnion credit scores will still accessible through MYFICO. Experian FICO scores will still be available to lenders. Experian has given no explanation for why it has decided to stop offering credit scores to consumers.

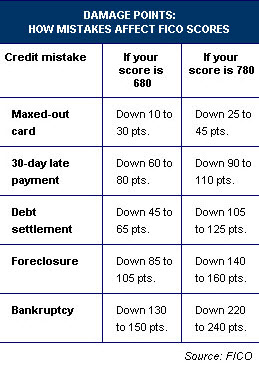

Credit scores are used by lenders when determining whether or not a consumer is eligible for a car loan and the interest rate that consumer will be offered. We urge all car buyers to keep up to date on their credit scores so that they have a reasonable idea of the interest rates they will be offered. Unfortunately, after Valentine’s Day, you won’t be able to see all three credit scores.

"Now banks can make decisions on a score that consumers can’t see," Mike Campbell, Fair Isaac’s chief operating officer, told The Wall Street Journal.

This move will allow lenders to make lending decisions and interest rate offers on information consumers have no access to. Now when you’re offered an interest rate for a car loan that’s much higher than what you expected based on your research, the lender can explain the discrepancy by saying that your Experian score was much lower than the other two scores. Since the three credit scores can often vary wildly, the lender could be telling the truth, but you would have no way to verify that.

If you apply for a car loan and your lender offers you an interest rate higher than you expected, always ask to see the credit report. This is especially important now that you can’t check your Experian report for yourself in advance.