-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

What is an Auto Loan Specific Credit Report?

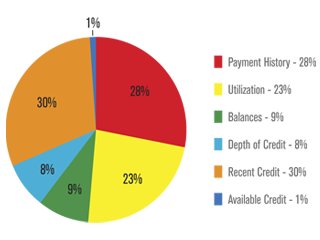

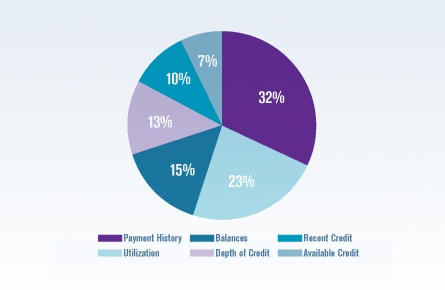

Credit reporting agencies have a credit report that is specifically tailored to auto loans. This auto loan specific credit report uses a different formula than a normal credit report. The auto loan specific credit report is available only to banks and credit agencies that give car loans and helps them decide how much of a risk you are.

The auto loan specific credit report looks at your credit history differently than a normal credit report. Because of this, you will have a different credit score on this credit check than on one done by a credit card company or done for you by the credit scoring company. The auto loan specific credit score will look at your history with car payments more than other things. So if you’ve gotten behind on bills before but have kept up to date on your car payment, you might be pleasantly surprised by the auto loan specific score.

So when you follow our advice and check your credit report before applying for a loan and the dealer tells you your score is different than what you saw on your credit check, don’t storm out! He might not be a lying, cheating, no-good swindler. He probably requested the auto loan specific credit check.

Image via fundershomeloans.