-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

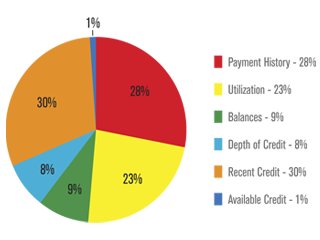

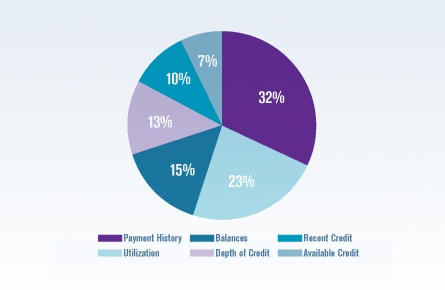

Auto Loan Lenders May be Looking at Vantage Score, Not FICO Score

Did you know that the FICO score isn’t the only credit score available? Because it has been around for so long, its name is almost synonymous with the words “credit score”. Credit score, FICO score – same thing, right?

Not at all. The FICO score is a scoring model from Fair Issac. FICO’s competitor, VantageScore, is a credit scoring model most people haven’t even heard of.

If you’re in the market for an auto loan, you should know what the VantageScore is because there are auto lenders who look at your VantageScore and use it to determine whether or not they will give you a car loan.

VantageScore was formed at the beginning of 2006 using a database with two years worth of information, says Barrett Burns, president and CEO of VantageScore Solutions, LLC. It was developed by Experian, Equifax and Transunion, the three major credit reporting companies. VantageScore’s range is from 501 to 990. The higher the score, the less risk a consumer poses to a lender.

Consumers repeatedly hear that they should check their credit score before they go to the dealer and apply for an auto loan. Should they check to see what their VantageScore is before they head to the dealer?

“This depends on what bank the dealer uses and if that bank uses VantageScore,” Burns says. “Seven of the top 50 auto lenders use VantageScore.”

What this means is that when you apply for the car loan, the lender may be using your VantageScore, not your FICO score, to determine whether or not they will approve you for the loan. If you don’t know what your VantageScore is, you may be at a disadvantage when it comes time to negotiate your financing.

Consumers can get their VantageScore from Experian and Transunion’s Web sites, Burns explains.

Although FICO scores and VantageScores are different, consumers should probably pull both to see where they’re at and realize that different lenders use different credit scores. Remember, the more you educate yourself and research all your financing options before you head to the dealer, you’ll walk out with the best auto loan rate you can get.