-

2018 Buick Enclave “Avenir” will have ionic air purifier - April 12, 2017

-

Lease a Luxury Car for Less Than You Think - April 5, 2017

-

Shopping for a Car When Your Credit is Low - March 31, 2017

-

Aston Martin Closer to Unveiling Second-Generation Vantage - March 21, 2017

-

2017 Bentley Bentayga SUV: Offroad for $238,000 and Up - March 14, 2017

-

Pagani Huayra is Finally Here, Only $2.4M - March 9, 2017

-

Mercedes AMG E63 – For When Your Wagon Needs Drift - February 6, 2017

-

2018 Audi Q5 SUV: Enhanced Performance - January 30, 2017

-

2018 Toyota Camry Due in Late Summer - January 27, 2017

-

2018 Dodge Challenger SRT Demon Will Outstrip Hellcat - January 23, 2017

Checking Your Credit Scores

Before you set foot on a dealer’s lot, or even before talking with lenders, you need to determine your credit score. Some organizations even argue this should be done at least 90 days in advance of buying a car. That way you have time to dispute and correct inaccuracies in your credit report that may be lowering your score and raising the interest rates you pay on loans.

Fortunately, under the 2003 Fair and Accurate Credit Transactions Act, every American is entitled to a free report. The credit reporting industry has put together a site called www.annualcreditreport.com, where you can request a free “credit file disclosure” once every 12 months from each of the big three credit reporting agencies – Equifax, Experian and TransUnion LLC.

The catch is that to get your credit score, also known as a FICO or BEACON score, they will charge you $5.95 to $7.95. This will get you what’s called the “Classic FICO Score.” FICO is an acronym for the Fair Isaac Corp., which devised a scoring system that essentially compares your credit information to that of other consumers to rank you as a credit risk.

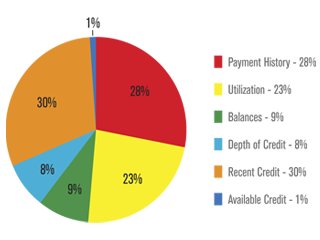

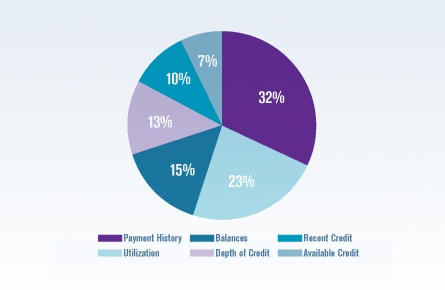

FICO scores range from 300 to 850. The higher your score, the less risky you appear to lenders. Your credit score is based on five factors:

- Past payment history

- Your total amount of outstanding debt

- How long you’ve had credit

- How much new credit you’ve sought recently

- The types of credit you have

The majority of us, about 58 percent, have the FICO scores of 700 or higher needed for the best auto financing deals out there.

Seems straight forward, right?

Problem is, each credit reporting agency publishes its own score based on what information it has in your credit report. For this reason you may hear lenders talking about BEACON (Equifax), Experian and Classic FICO (TransUnion) scores. Although Fair Isaac calculates all these scores using the same methods, they will differ depending on what information each agency has compiled on you.

That means there will be three FICO scores out there for the finance manager at the dealership to choose from when pricing your loan. Often a dealer will pull all your scores, quote you a loan based on the lowest one, and then collect a nice spread from the lender.

That’s why it’s critical for you to know all your FICO scores before stepping foot on the dealer’s lot. Make sure the finance manager tells you what FICO scores he is using to arrange your loan. If he quotes you a score lower than what you found, show him your FICO scores and see if he can do better.

Some car dealers actually use something called the “auto enhanced FICO score,” which focuses specifically on how you handled prior car loans and leases. In other words, car dealers are not particularly interested if you missed payments on your Sears credit card, because they know most people will pay their rent and car loans before paying other creditors. In other words, they may be willing to overlook delinquent payments to other creditors.

Unfortunately, consumers can’t even purchase their own auto enhanced FICO scores, but if you’ve managed your auto credit well, this score will generally be higher than your Classic FICO score, so you should expect more from lenders.